The provisions of subpart F contain many general rules, special rules, definitions, exceptions, exclusions, and limitations that require careful consideration.

For a discussion of IRC 482 see IRM 4.61.3 Development of IRC 482 cases.

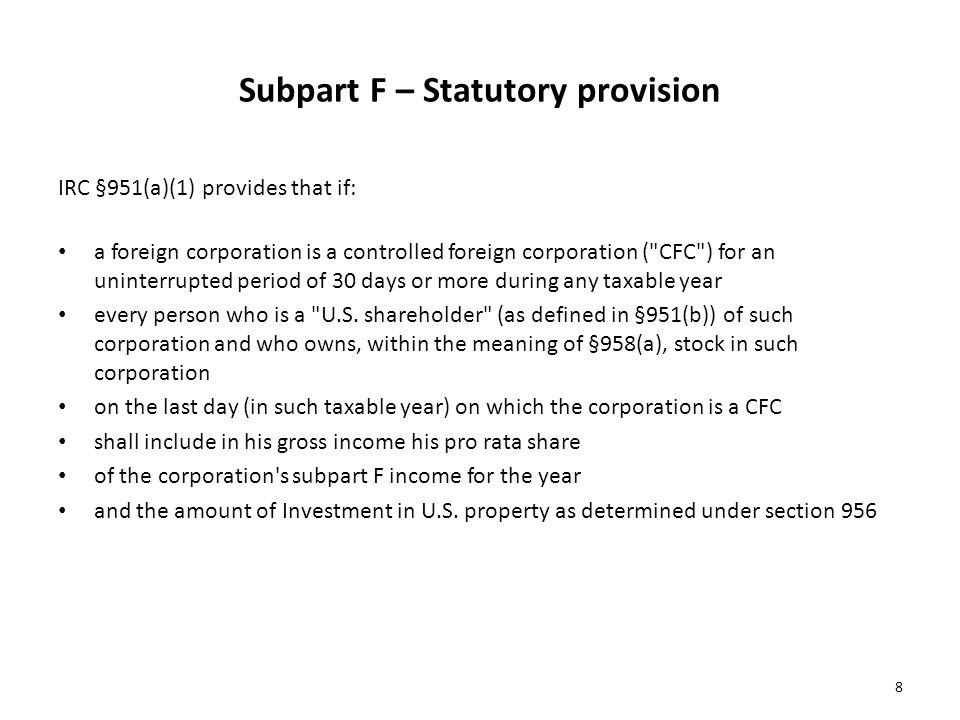

Any allocations of income and deductions between the CFC and its related organizations under IRC 482 are made before the application of the provisions of subpart F. It is essential that the relationships between CFCs and domestic entities be at arm’s length. The rules contained in subpart F are to be applied after the income of the CFC has been adjusted to conform to U.S. Certain previously deferred earnings were immediately taxable under the IRC 965 transition tax, and going forward, a new taxation subpart F regime was established for global intangible low-taxed income (GILTI) and a dividends received deduction for foreign source dividends were enacted. Taxation of foreign income earned by CFCs also significantly changed with the passage of TCJA in late 2017. shareholder in the year the income is earned by the CFC. It provides that certain types of income of CFCs, though undistributed, must be included in the gross income of the U.S.

#Irc 951 code

persons drastically changed with the introduction of subpart F into the Internal Revenue Code (IRC) in 1962. The taxation of foreign income earned by foreign corporations owned by U.S. 4.61.7.33 Special Rules and Recordkeeping Requirements of U.S.4.61.7.32 General Rules and Record Keeping Requirements of U.S.4.61.7.31.1 Foreign Tax Credit Audit Steps.4.61.7.31 Special Rules for Foreign Tax Credit.4.61.7.30 Adjustments to Basis of Stock Guidelines.4.61.7.29 Exclusion of Previously Taxed Earnings and Profits.4.61.7.28.1 Earnings and Profits Audit Steps.Property Limitation For Tax Years Prior to 1993 4.61.7.23 Increase in Earnings in U.S.4.61.7.22 Final Determination of Includible Subpart F Income.4.61.7.21 Global Intangible Low-Taxed Income (GILTI).4.61.7.20.1 Foreign Base Company Services Audit Steps.4.61.7.20 Foreign Base Company Services Income.4.61.7.19 Determination of Country of Use, Consumption, or Disposition Guidelines.4.61.7.18 Property Manufactured, Produced, Grown, or Extracted.4.61.7.16 Special Rule for Certain Branch Income.4.61.7.15.1 Foreign Base Company Sales Income Audit Steps.4.61.7.15 Foreign Base Company Sales Income.4.61.7.14.1 Foreign Personal Holding Company Income Audit Steps.4.61.7.14 Foreign Personal Holding Company Income.4.61.7.13.1 Foreign Base Company Income Audit Steps.

#Irc 951 full

0 kommentar(er)

0 kommentar(er)